Quaint

Attractively unusual or old-fashioned.

Oxford English Dictionary

At some point in human history it was probably quite accurate to describe the buggy whip business as a thriving industry. And no doubt the savvy buggy whip factory owner would have expanded his offerings to include riding crops, glitter sticks and possibly even a fashionable line of jodhpurs.

If by some miraculous turn of events, (piracy perhaps?), you found yourself smack dab in the middle of the 18th century awash in gold or silver or diamonds, (i.e. disposable income), investing in buggy whips and such would have been a safe and conservative venture on your part. After all, as long as you’ve got buggies, you’re going to need you some whips.

Funny thing happened though … you already know where I’m going with this … buggies disappeared. Mind you, it didn’t happen overnight, but considering the contraptions had been around for centuries, the speed at which they vanished from common use was alarming. And guess what? When you do not got buggies, you do not need you some buggy whips. Thus, all those horse-related buggy appurtenances faded away into near oblivion — with the noted exception of the Amish and Main Street, Disneyland — and became quaint.

Becoming quaint is a charming and fetching way for something to age and wane. Something that is quaint is a reminder to us of how and what things used to be. It hearkens our contemplation back to bygone days when life and times were slower and less complicated.

I mention all this because of something I read in the past few days; a study conducted by Ernst and Young entitled, From defense to offense, and subtitled, Distributed energy and the challenge of transformation in the utilities sector.

I know … blah, blah, blah. But give me just a few moments to connect some dots.

The informative report is a clarion call to the power-generating industry in America. According to the research, a singular event is about to occur in our country; that is, fiscal parity.

Let me ’splain.

Forever the corporations that built and operated the massive and oh-so-complex power plants and transmission grids that generated and conveyed electricity throughout our country not only cornered the market, they literally owned the corner. From the days of Thomas Edison, the production and distribution of electricity throughout America belonged to those with access to vast amounts of money, if for no other reason than it was extremely expensive to design, build and operate those machines and systems and networks. It was fairly simple economics.

But now, because of the rapid and dynamic development of renewable energy resources — solar power, to be specific — that singular event I mentioned is predicted to take place by the year 2020. The Ernst and Young authors claim that sometime that year, the cost of generating electricity from solar panels mounted on a house rooftop will be equal to buying the same amount of electricity from a local electric utility.

Let me restate that.

It means an average homeowner will be able to purchase, install and operate a household electrical system that will provide the same amount of electricity, at the same cost, as buying that electricity from a big, electric utility.

Wow.

The report begins with a dire warning:

Conventional centralized, dispatchable, fossil- or nuclear-based generation will gradually be impacted by the adoption of distributed energy resources (DER) by customers. For the US electric power sector, the question is not if or even when the change will come, but rather, how fast.

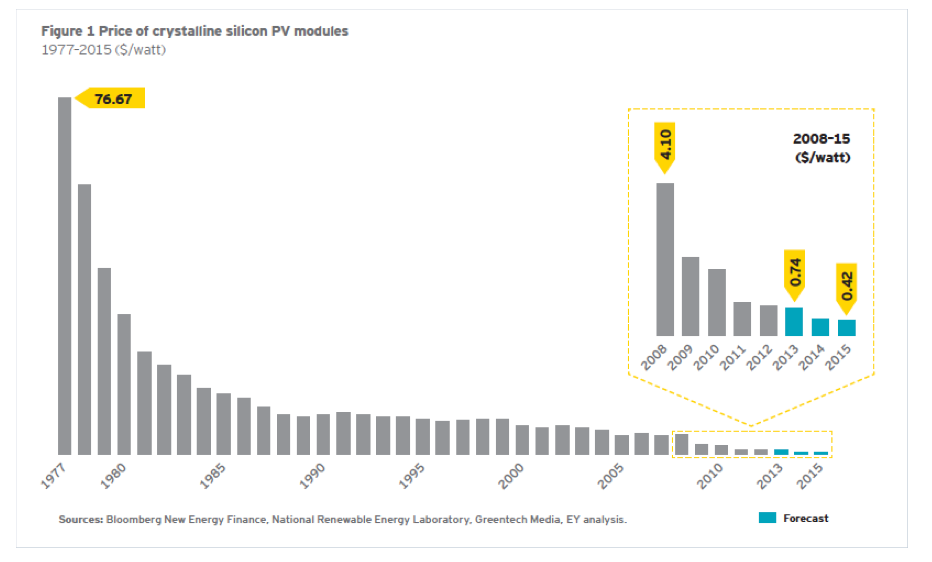

A graph provides some eye-opening data. In 1977, it cost over $76.00 to generate one watt of electricity using silicon photovoltaic (i.e. solar) modules. By 2008, that cost had dropped to just over $4.00 per watt. The projection is that by 2015, the cost will drop to about 40 cents per generated watt, and by 2020, it will likely be well below that. Simply put, that means the average Joe or Jill will be able to afford roof-mounted solar panels, and those solar panels will seriously reduce the amount of electricity purchased from the local utility. Again, it’s a matter of simple economics. If a business is unable to sell its product, that business will begin to shrink. That means a reduction in profits, which is something investors do not like. And if profits drop precipitously, investors will flee.

Ernst and Young is telling utility corporations that if they don’t jump on the distributed energy resources bandwagon now and in a very big way, their investors will leave them in the dust. The report even goes so far as to advise utilities that now is the time to create a plan to try and recoup some of their huge investments in nuclear and fossil-fuel power plants that will soon become outdated and unneeded.

Quick Aside

If you happen to own shares in an electric utility, I suggest you start paying very close attention to the decisions made by the board of directors, unless of course your investment portfolio specifically calls for penury and homelessness. Just a suggestion.

But enough of all that.

Let me bring this into sharp focus. Remember the buggy whip factories? They had been around for centuries. Horses and buggies were everywhere. Only a madman would have suggested it would one day come to a screeching halt.

And yet it did. Almost overnight.

It happened for a number of reasons, not the least of which was the burgeoning development of industrial technologies that began to overlap. Clever folks started combining those technologies and before long, one of them, Henry Ford, putt-putted out his workshop door and changed the world. And very quickly, very wealthy investors became convinced that the horse and buggy was a relic of the past. Investors saw Mr. Ford’s noisy contraption as “The Future”, and that’s where they put their money; by the trainload. And the same is about to occur with electricity. Think for a moment. If you had millions or billions of dollars to invest in things that make electricity, and you read the report from a highly reputable company like Ernst and Young?

Let me clarify one thing.

The closing paragraph of Ernst and Young’s report states:

Management theory has consistently questioned the ability of incumbents to transform versus succumbing to the forces of creative destruction and becoming irrelevant from both a customer and shareholder perspective … However, utilities have no choice but to adapt or become extinct like so many businesses in other industries that failed to transform; those dinosaurs became the stuff whereof business school case studies are made.

Dinosaurs? Strong stuff, that. This isn’t a bunch of New Age environmentalists climbing into trees and waving banners. These are serious-minded business folk who, having put their collective ear to the rail, are now saying, “There’s a train coming down the tracks”. They’re doing their best to transform the utility industry now while it still has a chance to change. But if the utilities wait too long?

They’ll become quaint, like buggy whips.