I watched a newscast interview last night. The guy being interviewed owns a small business. He makes over $250K annually. The report didn’t say how much over $250K the guy makes, but regardless, he makes a decent income from his small business.

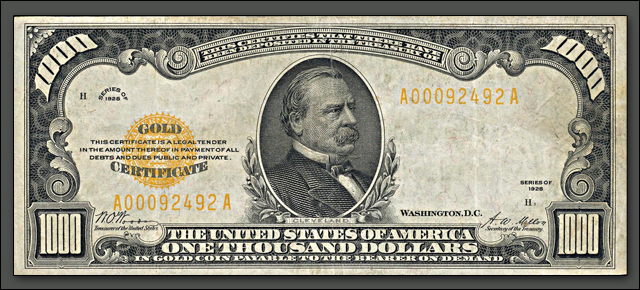

Asked if the tax increase proposed by President Obama will adversely affect his business, the guy said, “Yes, and it will affect how much I’ll be able to pay my employees and whether I can hire more people”. According to the report, the proposal would increase this guy’s business tax by $8,000.00. ($8K.)

Let me rephrase this to make sure I understand. I make over $250K every year from my small business. President Obama is proposing to increase my taxes by 3% on income that exceeds $250K. So if I make $260K, only the extra $10K will be taxed at the higher rate. But I’m such a crappy businessman, that extra 3% above my already comfortable income of $250K might cause my business to waffle and crumble?

What?

Another small businessman was interviewed. His business is also going to get hit by the 3% increase, but he’s happy as a clam. “It’s a part of doing business,” he said. “My business is growing, and paying a few thousand more in taxes won’t slow me down one bit.”

Let’s just get something straight. If you make over $250,000.00 every year from the proceeds of your small business, you have the means to live rather comfortably in America. (Yeah, I know, not in downtown Manhattan, San Francisco or other horrifically expensive cities. But that’s the exception, not the rule.) You can own a nice house in a nice neighborhood, and drive a fairly new car. You can afford health insurance. If you have kids, you can feed and clothe them handsomely. You can even afford to send them to a private school. You can take a vacation and enjoy life.

In other words?

Over 95% of your fellow citizens would trade incomes with you in a heartbeat, and gladly pay an extra 3% tax on whatever they earn north of $250K.

Jeez.